The container market is confronting more than its fair share of headwinds. Recently the global shipping consultancy, Drewry, published Container Forecaster highlighting concerns of a slowing global economy stoked by the ongoing US-China trade war (albeit paused for the moment), escalating geopolitical tension in many regions of the world and an industry grappling with challenging new emission regulations. Beyond these, however, a series of existential fears, namely, the regionalization of manufacturing supply chains and growing momentum behind a low carbon, an environment-first campaign that has the potential to fundamentally change global consumption habits are also beginning to present themselves that could dent demand for shipping in the future; .

Because of all these reasons Drewry has downgraded its forecast for global port throughput growth from previous prediction of 3.9% to 3.0% in 2019 .

“We remain confident that world trade will rebound in 2020, but much will depend on developments outside of carriers’ control,” said Simon Heaney, senior manager, container research at Drewry and editor of the Container Forecaster.

“Further spreading of protectionist policies could stunt growth, particularly if the US aims its tariff target at other trading partners. However, there could be some upside for trade if more manufacturing production is relocated outside of China. The Asian export powerhouse has progressively reduced its requirement for foreign inputs, choking off demand for intermediate goods, so any shift to less self-reliant economies should give trade a bit of a kick-start,” Heaney said.

Drewry believes the risk of temporary supply disruption has gained a height in such unpredictable times.

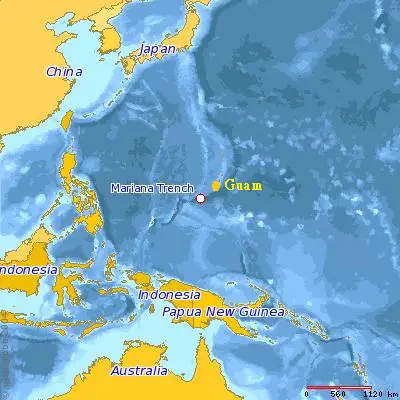

For example, in the Transpacific market, there is divergent strategies from carriers due to differences of opinion over the strength of the third quarter peak season. Extra loaders are placed into the trade by some lines, indicating they expect a repeat of last year’s cargo rush, while others are more circumspect, announcing blanked sailings to protect load factors and spot freight rates.

“Carriers can be forgiven for not having all of the answers in such times. One suspects that even Nostradamus would throw his hands up in despair; such is the volatility of the leading characters. There will undoubtedly be some errors along the way and the risk of temporary supply issues has undoubtedly been raised, either from too many cancelled sailings or misplaced capacity transfers between trades,” said Heaney.

Reference: drewry.co.uk

from WordPress https://www.maritimemanual.com/drewry-publishes-container-forecaster-regarding-slowing-global-economy/

No comments:

Post a Comment