The impact of five megatrends on the container industry Demographic changes, shifts in economic power, technological innovations. These are megatrends, each of which is changing the world around us. Trends that will certainly also impact container ports and the container industry. This white paper examines 5 themes:

• evolving global trade

• ongoing scale increases, consolidation and integration

• hinterland networks

• logistics patterns and digital transformation

• important IT innovations for container ports

The impact on the container industry is described per theme and how supply chain stakeholders can anticipate potential future scenarios is examined.

Evolving global trade

The share of international trade in global production has been growing steadily for many years as a consequence of the disappearance of statutory and cultural obstacles (both regionally as well as globally) for the global economy. For now, there seems to be no end to this growth; in the near future, it is expected that growth in trade will be greater than total production growth. Most of this international trade takes place within and between a number of large economic blocks, such as NAFTA and the European Union in which the latter, for various reasons, has important relations with the rest of the world. However, growth differences are evident between the EU member states. Eastern European countries are reporting higher growth in gross national product partly as a consequence of their economic development phase, and because of their connections with non-EU countries. A clear long-term hinterland vision is indispensable in this context for Western European container ports.

The world economy is also subject to increasing influence from developing countries and transition economies. In other regions of the world, population growth is much higher than in Western Europe. In the long term, this may result in a shift of economic centres and trade flows.

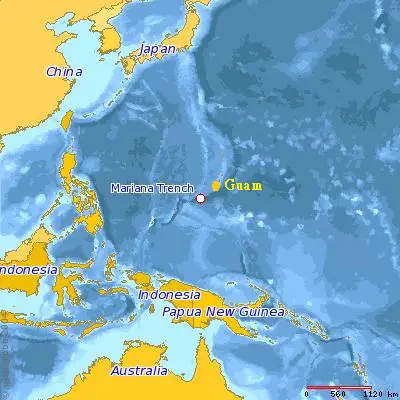

Stakeholders are using various initiatives in an attempt to anticipate this shift. For instance, China presented the ‘One Belt One Road’ initiative in 2013, later renamed the ‘Belt and Road Initiative’ (BRI). The objective of this initiative is to break through connectivity bottlenecks in Asia and promote economic cooperation between the western part of the Pacific Ocean and the Baltic Sea by investing in infrastructure; both on land as well as oversea. Some 60 countries, with a combined population of 4.4 billion people, are now involved in this initiative.

Another concept that will further develop and influence global supply chains is ‘nearshoring’, in which work is transferred to other low-wage countries. This concept is, however, not appropriate for each sector. The exploration of specific options continues to be an individual exercise, in which both quantitative as well as qualitative aspects should be taken into account. Such exercise forms an excellent foundation for shippers and logistics partners to redefine the supply chain and open the door for new forms of cooperation and cargo flows.

Ongoing scale increases, consolidation and integration

One of the consequences of growing global trade is ever increasing pricing pressure. Container shipping companies view scale, for example in the form of operational cooperation, as one of the most effective methods of withstanding pricing pressure. Operational cooperation between container shipping companies takes many forms, varying from slot chartering and agreements for sharing vessels, through to strategic alliances.

A new generation of alliances has been redistributing the market in recent years. In early 2016, the twenty largest shipping companies controlled approximately 86% of global container shipping capacity. As comparison: in 1990, this was ‘just’ 56% and was only 26% in 1980. Just the top three (Maersk Line, MSC and CMA-CGM) supply approximately 40% of global fleet capacity.

The question is whether alliances will continue to play a role in the ongoing consolidation of the container shipping industry, which is characterised by a smaller number of players, more insecurity, higher risks and increased demand for faster handling of shipping.

Shipping companies have always emphasised on costs and asset management. There has been a significant focus on larger, more fuel-efficient vessels since the 1990s. The size of a typical container ship on the Far East-Europe trade-lane increased from 4,500-5,500 TEU in 2000 to over 19,000 TEU in 2018, with some vessels even achieving a capacity of over 21,000 TEU. The number and size of these mega container vessels have considerable consequences for ports and port operators. The impact of growing freight flows on such things as transhipment hubs and infrastructure is huge.

Simultaneous handling of these large container ships results in higher peaks in container terminal operations and requires storage and handling facilities and capacities that are large enough to process these container volumes. Terminal opening hours will need to be extended, while waiting time at the terminal and congestion on the roads will increase. This forms a huge challenge for all parties concerned.

The coordination of different transport modes, synchromodality and hinterland connections will need to be optimised, for instance using digitisation. It is not without reason that parties (particularly larger parties) are focusing increasingly on logistics integration and IT implementation. At the same time, port operators across the world are continuing to create global terminal networks that enable reliable service levels and working methods.

Hinterland networks

Of course, the above-mentioned megatrends also influence the hinterland networks. Existing transport corridors by rail, road and inland waterways between the core of the EU, the Baltic Sea, the Mediterranean Sea area, Eastern and Central Europe and third countries will gain ground. A number of new corridors will also be created to process the increasing transport volumes within and between member states. The development of these corridors is being strengthened by the realisation of the Trans-European Transport Network and by rail company, mega-carrier and other market party initiatives to expand their European transport networks. As well as infrastructure, frequency and capacity, reliability will be a determining factor for the successful operation of these corridors.

The European hinterland is characterised by the presence of various well-developed logistics zones. At first glance, these zones appear to form a threat to the larger seaports, but by moving with the market and investing in new developments, the seaports can convert these threats into new opportunities. The interaction between seaports and inland ports will result in the development of a larger logistics pool comprising multiple logistics zones, in which a further integration of intermodal transport and supply chain management will result in new services and added value. The availability of fast, efficient and reliable intermodal connections is one of the most important conditions in this.

Terms such as modal shift and co-modality have been replaced in this context by the ‘synchromodality’ concept (the optimum, flexible and sustainable deployment of various modes of transport in a network under the management of a logistics service provider, to offer the shipper or freight forwarder an integrated solution for its land and other transport). An important feature of the concept is that few parties want to take the lead in finding and implementing such a synchro-modal solution. Shipping companies, terminal operators, inland shipping terminals, inland transporters, 3PL services, shippers and governments each play their own role. This makes the transport system more flexible in terms of modality choice. Moreover, synchromodality enables cargo consolidation, which offers additional efficiency advantages. Synchromodal transport offers the greatest potential on corridors and in regions where volumes are sufficiently high.

Logistics patterns and digital transformation

In view of synchromodality, it is expected that supply chains will also be redesigned in the future. After all, companies have no option but to operate as sustainable and efficient as possible; partly as this is increasingly prescribed by legislation and regulations and demanded by consumers, and partly because it reduces waste and fuel costs. More (horizontal) cooperation will be needed to respond to the requirement for shorter, more sustainable and costefficient supply chains. Using data analysis and transparency to streamline supply chains via segmentation and standardisation will result in a flexible ‘plug-and-play’ logistics chain. In order to achieve operational excellence, physical flows and data within these chains will be coordinated precisely using increasingly smarter and more powerful IT systems.

In accordance with the ALICE European Technology Platform (Alliance for Logistics Innovation through Collaboration in Europe), the supply chain will evolve to become an open, general logistics system, based on physical, digital and operational interconnectivity. According to ALICE, the objective of such an open system is ‘to produce, move, store, deliver and use physical objects across the world; in a way that is economical, ecological, socially efficient and sustainable.’ This demands total standardisation of internationally recognised codes. Various transport systems and IT platforms will need to integrate horizontally and vertically in order to develop into an open IT infrastructure for the total logistics sector.

The increased involvement of 3PL services and shipping companies in streamlining supply chains, as well as the progress in data analysis and visibility, are placing traditional freight forwarders under increased pressure. New technology could even make traditional freight forwarders largely superfluous, as a consequence of increased digitisation (of transactions, online sales, direct orders and automated processes). At the same time, Big Data and digital solutions are providing shippers with improved information. This will result in greater tariff transparency and increased the visibility of scheduled services, availability of resources and general performance. It is up to the various stakeholders to embrace the changes and to work together to develop the logistics chain of the future.

The way in which supply chains are controlled in the future also influences the role of ports. After all, when fixed assets are less determining for cargo flow routing, the route choice (and thus the port choice) will not be decided very far in advance. This is actually extremely dynamic, flexible and resilient; depending on such things as real-time optimisation of asset capacity utilisation – including vessels, hinterland modes and bottleneck infrastructure – and environmental aspects. In that respect, ports that play an extremely prominent neutral broker role within digital and/or automatic choice systems have a real advantage over the competition.

Important IT innovations for container ports

Competition is becoming fiercer throughout the logistics sector. And yet there are certainly also opportunities, for example because of IT innovations. The port sector has already embraced this technology to a certain extent. Some innovations are particularly relevant and will continue to influence almost all aspects of the trade process in the future.

Robotics and automation

Automation in the ports has improved significantly since the introduction of automated cranes at the European Container Terminal in Rotterdam in 1990. There is a reliance on automation in almost all terminal functions these days, from water to land, including handling on or from the shore-based modes. The extent to which this takes place varies from remote-controlled operations under safe and efficient circumstances to automated and fully autonomous terminal operations. The driving forces behind this automation are employment costs, land lease fees and the need for efficient handling of larger vessels.

Automation can also play an essential role in transforming logistics services. For instance, technological progress enables increasing real-time insight into dynamic pricing, schedules, booking, shipments, etc.

Important IT innovations for container ports

The most visible and often most advanced innovation concerns ‘robots’ in all types and sizes used as autonomous vehicles; from the smaller last mile solutions to fully-automated sea-going vessels. Future developments in autonomous vehicles will undoubtedly impact the organisation of operations in container ports.

The direct impact on port operations can be seen in improved efficiency as a result of such things as error-free handling, improved planning and synchronised timing. Drones can also be used to safeguard security in the port and play a role in monitoring port activities. They can also be used to track assets that require maintenance, both in terms of port equipment and vessels. For autonomous vessels, the story is somewhat more complex. It is clear that fuel consumption of autonomous vessels is considerably lower than that of manned vessels, which also means lower emissions. And yet, there is an important hurdle:

international maritime conventions, in which the minimum crew requirements for sea-going vessels are clearly stated. Safety also continues to be a concern for the time being; for instance how unmanned vessels handle severe weather and obstacles, or how repairs are carried out during the voyage. In the long term, however, as most shipping accidents are the consequence of human error, safety at sea could certainly be substantially improved using autonomous vessels.

Internet of Things and big data

The increasingly rapid development of cheap sensors has led to more and more machinery and resources being equipped with such sensors. This effectively means that they can be tracked and that each activity, or each circumstance to which they are exposed, can be measured. Moreover, machinery and resources are capable of communicating with each other and with a network: the Internet of Things.

The Internet of Things also offers a wide range of opportunities for the container industry. A tremendous amount of data (big data) becomes available by connecting autonomous vessels, port equipment, infrastructure and freight. This offers opportunities to optimise processes and obtain increasingly more precise and real-time insight for all container industry stakeholders. Robust communication systems are indispensable in this.

Finally, the availability of big data enables full utilisation of the advantages of simulation software. Port operations can be modelled in order to analyse operational flows, trace possible bottlenecks and define improvements. An additional advantage is that such simulation software can also be used to train personnel.

Press Releases: Port Of Rotterdam

Photo Courtesy: Port Of Rotterdam

The post Port Of Rotterdam Highlights Impact Of Five Mega Trends On Container Industry appeared first on Maritime Manual.

from WordPress https://ift.tt/2EmKNn1

No comments:

Post a Comment