Thursday, March 28, 2019

Friday, March 22, 2019

Wednesday, March 20, 2019

Sunday, March 17, 2019

Tuesday, March 12, 2019

Sunday, March 10, 2019

Friday, March 1, 2019

Diana Shipping Back to Black in 4Q 2018

The company delivered a net income of USD 2.9 million and net income attributed to common stockholders of USD 1.5 million for the three months ended December 31, 2018. In the same period a year earlier, Diana Shipping recorded a net loss of USD 436.9 million and a net loss attributed to common stockholders of USD 438.4 million, including a USD 422.5 million impairment loss.

Time charter revenues reached USD 62.9 million, rising from USD 48.9 million reported in the fourth quarter of 2017. The increase in time charter revenues was due to increased average time charter rates that the company achieved for its vessels during the quarter and was partly offset by decreased ownership days resulting from the sale of two vessels in December 2018.

For the full year, Diana Shipping’s net income and net income attributed to common stockholders amounted to USD 16.6 million and USD 10.8 million, compared to a net loss and net loss attributed to common stockholders of USD 511.7 million and USD 517.5 million reported in 2017.

Time charter revenues were USD 226.2 million for the year ended December 31, 2018, surging from USD 161.9 million achieved in 2017.

Separately, Diana Shipping commenced a tender offer to purchase up to 5,178,571 shares, or about 4.9%, of its outstanding common stock using funds available from cash and cash equivalents at a price of USD 2.80 per share, on February 27.

The Board of Directors determined that it is in the company’s best interest to repurchase shares at this time given Diana Shipping’s cash position and stock price.

Press Releases: Dian Shipping Inc.

The post Diana Shipping Back to Black in 4Q 2018 appeared first on Maritime Manual.

from WordPress https://ift.tt/2NFCvec

Corvus Energy Wins World’s Largest Battery Package Order for Hybrid Vessels

As informed, the technology will be installed onboard Havila Kystruten’s environmentally-friendly coastal vessels.

“This is a big step for the cruising industry and we are extremely proud to receive this order… The Energy Storage System (ESS) is the world’s largest package ever delivered to a ship and will enable the vessels to enter fjords and ECAs on zero emission mode five years before the deadline,” Geir Bjørkeli, CEO of Corvus Energy, said.

Corvus Energy will deliver an air-cooled ESS with Corvus’ patented single-cell thermal isolation which exceeds class requirements.

“The Energy Storage System has a capacity per vessel of 6,100 kWh, which is double the capacity of any existing battery-operated vessel,” Roger Rosvold, Vice President Sales at Corvus Energy, explained.

“The unused potential for using batteries on board cruise and passenger ferries is huge. Batteries reduce fuel consumption and maintenance costs, cut pollution and, with increasing environmental regulations and requirements that will incur costs for air emissions, provide a very compelling business case.”

“As more and more shipowners wake up to this, we expect to see uptake accelerating across the board. The industry is just starting to understand the power of batteries,” Rosvold further said.

The newbuilds are part of Havila’s contract with Norwegian Ministry of Transport for the construction of four environmentally-friendly vessels that will operate on the Bergen-Kirkenes coastal route.

Two of the vessels will be built by Turkish shipbuilder Tersan and the remaining by Spanish Barreras. Featuring a length of 125 meters and a width of 20 meters, the ships will be able to accommodate 700 passengers.

The vessels will have a hybrid gas-electric propulsion system with battery, where four gas-powered engines in each vessel run the generators. The system is also adapted to the next generation of technology, using hydrogen fuel cells.

The equipment from Corvus Energy is scheduled for delivery in 2020 and the coastal route vessels will be in service from 2021.

Press Releases: Corvus Energy

The post Corvus Energy Wins World’s Largest Battery Package Order for Hybrid Vessels appeared first on Maritime Manual.

from WordPress https://ift.tt/2ErTJar

ZPMC Invests in COSCO to Enhance Business with Terminal Companies

ZPMC recently signed the share subscription agreement with COSCO Shipping Holdings for private A share of 111,111,111 at the price of CNY 3.78 for each share.

As explained, the investment is expected to further deepen collaboration between ZPMC and COSCO in the port machinery, maritime engineering as well as services and logistics.

Specifically, ZPMC intends to enhance business with various terminal companies by using COSCO’s industrial influence on terminal companies around the globe.

The crane manufacturer expects long-term benefits of this strategic partnership.

COSCO Shipping Holdings, which is principally engaged in container shipping and related businesses, is a subsidiary of China Ocean Shipping (Group) Company (COSCO), the largest integrated shipping company in China.

Press Release:

The post ZPMC Invests in COSCO to Enhance Business with Terminal Companies appeared first on Maritime Manual.

from WordPress https://ift.tt/2T5ebIq

ING And EIB Provide €110m For Spliethoff’s Green Shipping Investments

ING and the European Investment Bank (EIB) signed a EUR 110m loan agreement to finance Dutch ship management company Spliethoff’s Bevrachtingskantoor B.V. for the retrofitting of 42 vessels of its fleet with exhaust gas cleaning systems and ballast water management systems.

This will enable Spliethoff to be compliant with the International Maritime Organisation (IMO) and EU regulations governing air emissions and prevention of the release of seaborne pathogens that are harmful to the marine environment.

The EIB loan will be supported by the European Fund for Strategic Investments (EFSI), the main pillar of the Investment Plan for Europe, as well as the “Connecting Europe Facility” (CEF).

The loan is part of the ING and EIB €300m Green Shipping partnership signed in 2018, to support sponsors of green and sustainable projects in the maritime transport sector with advantageous financial terms. The EIB will contribute €49.5 million to a €110.4m ING Bank NV arranged facility to finance the installation of exhaust gas cleaning systems and ballast water management systems on 42 vessels for Spliethoff’s Bevrachtingskantoor B.V.

In specific 17 vessels will be retrofitted with both exhaust gas cleaning systems and ballast water management systems, 5 vessels with exhaust gas cleaning systems and 20 vessels with ballast water management systems.

The retrofitted vessels will operate with significantly reduced emissions of sulphur oxide (SOx) and particulate matter (PM) pollutants and prevent the seaborne transfer of invasive species and diseases in ballast water.

Loyens & Loeff, the transaction law firm responsible for this deal on behalf of ING Bank, coordinates documentation between Spliethoff, the EIB and ING.

EIB Vice-President Vazil Hudak stated: “Our joint programme with ING shows that greening the transport sector makes business sense, other than just being important for the environment. The support from the European Commission helps to make the maritime transport sector easier to finance for the Bank, a good example of cross-European teamwork.”

Michel Fransen, CFO of the Spliethoff Group said: “We have been installing scrubbers on our fleet since 2013 and are very happy with the results so far. Scrubbers are a very environmentally friendly solution to comply with the 2020 regulations. LNG or hydrogen may have the potential to become even better alternatives in the future, but only in the longer term. The investment in scrubbers also safeguards the interest of our shareholders against uncertainties in fuel availability and pricing.”

Stephen Fewster, Head of ING Shipping said: “Sustainability is an important strategic priority for ING. As a bank, we make the most impact through our financing. Therefore we are very proud to partner with the EIB to provide financing to Spliethoff to support their transition to a more sustainable business model while also meeting increasing environmental standards.”

Press Releases: spliethoff.com

Photo Courtesy: spliethoff.com

The post ING And EIB Provide €110m For Spliethoff’s Green Shipping Investments appeared first on Maritime Manual.

from WordPress https://ift.tt/2EyZ0xl

ABS Expands Guide For International Naval Ships

ABS updated its Guide for Building and Classing International Naval Ships (INS Guide), expanding its industry-leading guidance to strengthen safety and protection against a range of threats.

“ABS is a world leader in naval classification and our 2019 INS Guide takes this to the next level,” said ABS Senior Vice President for Global Government, James Watson. “Naval vessels face an increasingly sophisticated range of threats and the ABS guidance is evolving to keep pace with the challenges they face, supporting more reliable and mission-ready fleets.”

The Guide features new sections on Mission Threats Protection which consist of new notations to demonstrate a vessel meets the Allied Naval Engineering Publication (ANEP) 77 standard, as well as Ballistics, Fragmentation, and Air Blast protection.

The notations respond to requests from navies around the world and are now being offered for a range of combatant and non-combatant vessels.

The new ABS NavalSafe notation determines safety and performance standards for government combatant and non-combatant vessels in line with the North Atlantic Treaty Organization’s Naval Ship Code. Compliance with the code allows governments to learn from international best practice, realize cost-effective regulation and demonstrate commitment to achieving greater levels of safety to stakeholders.

A new chapter on Ballistics and Fragmentation introduces technical guidance for achieving a level of protection for Naval ships against direct fire weapons, based on the mission requirements, anticipated threats and results of vulnerability assessments. Naval ships complying with this chapter may be issued an optional BFP1, BFP2, or BFP3 notation, depending on the level of protection applied to the vessel. Such notations are private, ensuring details of a vessel’s protection remain confidential.

The Air Blast guidance provides a methodology for analyzing vessel structure for the desired level of protection, including blast pressure and resistance curves enabling designers to quickly assess the impact of different scenarios. The Guide also contains examples to help the user better understand this complex issue.

Press Releases: ABS

The post ABS Expands Guide For International Naval Ships appeared first on Maritime Manual.

from WordPress https://ift.tt/2Td79BL

Port Of Rotterdam Highlights Impact Of Five Mega Trends On Container Industry

The impact of five megatrends on the container industry Demographic changes, shifts in economic power, technological innovations. These are megatrends, each of which is changing the world around us. Trends that will certainly also impact container ports and the container industry. This white paper examines 5 themes:

• evolving global trade

• ongoing scale increases, consolidation and integration

• hinterland networks

• logistics patterns and digital transformation

• important IT innovations for container ports

The impact on the container industry is described per theme and how supply chain stakeholders can anticipate potential future scenarios is examined.

Evolving global trade

The share of international trade in global production has been growing steadily for many years as a consequence of the disappearance of statutory and cultural obstacles (both regionally as well as globally) for the global economy. For now, there seems to be no end to this growth; in the near future, it is expected that growth in trade will be greater than total production growth. Most of this international trade takes place within and between a number of large economic blocks, such as NAFTA and the European Union in which the latter, for various reasons, has important relations with the rest of the world. However, growth differences are evident between the EU member states. Eastern European countries are reporting higher growth in gross national product partly as a consequence of their economic development phase, and because of their connections with non-EU countries. A clear long-term hinterland vision is indispensable in this context for Western European container ports.

The world economy is also subject to increasing influence from developing countries and transition economies. In other regions of the world, population growth is much higher than in Western Europe. In the long term, this may result in a shift of economic centres and trade flows.

Stakeholders are using various initiatives in an attempt to anticipate this shift. For instance, China presented the ‘One Belt One Road’ initiative in 2013, later renamed the ‘Belt and Road Initiative’ (BRI). The objective of this initiative is to break through connectivity bottlenecks in Asia and promote economic cooperation between the western part of the Pacific Ocean and the Baltic Sea by investing in infrastructure; both on land as well as oversea. Some 60 countries, with a combined population of 4.4 billion people, are now involved in this initiative.

Another concept that will further develop and influence global supply chains is ‘nearshoring’, in which work is transferred to other low-wage countries. This concept is, however, not appropriate for each sector. The exploration of specific options continues to be an individual exercise, in which both quantitative as well as qualitative aspects should be taken into account. Such exercise forms an excellent foundation for shippers and logistics partners to redefine the supply chain and open the door for new forms of cooperation and cargo flows.

Ongoing scale increases, consolidation and integration

One of the consequences of growing global trade is ever increasing pricing pressure. Container shipping companies view scale, for example in the form of operational cooperation, as one of the most effective methods of withstanding pricing pressure. Operational cooperation between container shipping companies takes many forms, varying from slot chartering and agreements for sharing vessels, through to strategic alliances.

A new generation of alliances has been redistributing the market in recent years. In early 2016, the twenty largest shipping companies controlled approximately 86% of global container shipping capacity. As comparison: in 1990, this was ‘just’ 56% and was only 26% in 1980. Just the top three (Maersk Line, MSC and CMA-CGM) supply approximately 40% of global fleet capacity.

The question is whether alliances will continue to play a role in the ongoing consolidation of the container shipping industry, which is characterised by a smaller number of players, more insecurity, higher risks and increased demand for faster handling of shipping.

Shipping companies have always emphasised on costs and asset management. There has been a significant focus on larger, more fuel-efficient vessels since the 1990s. The size of a typical container ship on the Far East-Europe trade-lane increased from 4,500-5,500 TEU in 2000 to over 19,000 TEU in 2018, with some vessels even achieving a capacity of over 21,000 TEU. The number and size of these mega container vessels have considerable consequences for ports and port operators. The impact of growing freight flows on such things as transhipment hubs and infrastructure is huge.

Simultaneous handling of these large container ships results in higher peaks in container terminal operations and requires storage and handling facilities and capacities that are large enough to process these container volumes. Terminal opening hours will need to be extended, while waiting time at the terminal and congestion on the roads will increase. This forms a huge challenge for all parties concerned.

The coordination of different transport modes, synchromodality and hinterland connections will need to be optimised, for instance using digitisation. It is not without reason that parties (particularly larger parties) are focusing increasingly on logistics integration and IT implementation. At the same time, port operators across the world are continuing to create global terminal networks that enable reliable service levels and working methods.

Hinterland networks

Of course, the above-mentioned megatrends also influence the hinterland networks. Existing transport corridors by rail, road and inland waterways between the core of the EU, the Baltic Sea, the Mediterranean Sea area, Eastern and Central Europe and third countries will gain ground. A number of new corridors will also be created to process the increasing transport volumes within and between member states. The development of these corridors is being strengthened by the realisation of the Trans-European Transport Network and by rail company, mega-carrier and other market party initiatives to expand their European transport networks. As well as infrastructure, frequency and capacity, reliability will be a determining factor for the successful operation of these corridors.

The European hinterland is characterised by the presence of various well-developed logistics zones. At first glance, these zones appear to form a threat to the larger seaports, but by moving with the market and investing in new developments, the seaports can convert these threats into new opportunities. The interaction between seaports and inland ports will result in the development of a larger logistics pool comprising multiple logistics zones, in which a further integration of intermodal transport and supply chain management will result in new services and added value. The availability of fast, efficient and reliable intermodal connections is one of the most important conditions in this.

Terms such as modal shift and co-modality have been replaced in this context by the ‘synchromodality’ concept (the optimum, flexible and sustainable deployment of various modes of transport in a network under the management of a logistics service provider, to offer the shipper or freight forwarder an integrated solution for its land and other transport). An important feature of the concept is that few parties want to take the lead in finding and implementing such a synchro-modal solution. Shipping companies, terminal operators, inland shipping terminals, inland transporters, 3PL services, shippers and governments each play their own role. This makes the transport system more flexible in terms of modality choice. Moreover, synchromodality enables cargo consolidation, which offers additional efficiency advantages. Synchromodal transport offers the greatest potential on corridors and in regions where volumes are sufficiently high.

Logistics patterns and digital transformation

In view of synchromodality, it is expected that supply chains will also be redesigned in the future. After all, companies have no option but to operate as sustainable and efficient as possible; partly as this is increasingly prescribed by legislation and regulations and demanded by consumers, and partly because it reduces waste and fuel costs. More (horizontal) cooperation will be needed to respond to the requirement for shorter, more sustainable and costefficient supply chains. Using data analysis and transparency to streamline supply chains via segmentation and standardisation will result in a flexible ‘plug-and-play’ logistics chain. In order to achieve operational excellence, physical flows and data within these chains will be coordinated precisely using increasingly smarter and more powerful IT systems.

In accordance with the ALICE European Technology Platform (Alliance for Logistics Innovation through Collaboration in Europe), the supply chain will evolve to become an open, general logistics system, based on physical, digital and operational interconnectivity. According to ALICE, the objective of such an open system is ‘to produce, move, store, deliver and use physical objects across the world; in a way that is economical, ecological, socially efficient and sustainable.’ This demands total standardisation of internationally recognised codes. Various transport systems and IT platforms will need to integrate horizontally and vertically in order to develop into an open IT infrastructure for the total logistics sector.

The increased involvement of 3PL services and shipping companies in streamlining supply chains, as well as the progress in data analysis and visibility, are placing traditional freight forwarders under increased pressure. New technology could even make traditional freight forwarders largely superfluous, as a consequence of increased digitisation (of transactions, online sales, direct orders and automated processes). At the same time, Big Data and digital solutions are providing shippers with improved information. This will result in greater tariff transparency and increased the visibility of scheduled services, availability of resources and general performance. It is up to the various stakeholders to embrace the changes and to work together to develop the logistics chain of the future.

The way in which supply chains are controlled in the future also influences the role of ports. After all, when fixed assets are less determining for cargo flow routing, the route choice (and thus the port choice) will not be decided very far in advance. This is actually extremely dynamic, flexible and resilient; depending on such things as real-time optimisation of asset capacity utilisation – including vessels, hinterland modes and bottleneck infrastructure – and environmental aspects. In that respect, ports that play an extremely prominent neutral broker role within digital and/or automatic choice systems have a real advantage over the competition.

Important IT innovations for container ports

Competition is becoming fiercer throughout the logistics sector. And yet there are certainly also opportunities, for example because of IT innovations. The port sector has already embraced this technology to a certain extent. Some innovations are particularly relevant and will continue to influence almost all aspects of the trade process in the future.

Robotics and automation

Automation in the ports has improved significantly since the introduction of automated cranes at the European Container Terminal in Rotterdam in 1990. There is a reliance on automation in almost all terminal functions these days, from water to land, including handling on or from the shore-based modes. The extent to which this takes place varies from remote-controlled operations under safe and efficient circumstances to automated and fully autonomous terminal operations. The driving forces behind this automation are employment costs, land lease fees and the need for efficient handling of larger vessels.

Automation can also play an essential role in transforming logistics services. For instance, technological progress enables increasing real-time insight into dynamic pricing, schedules, booking, shipments, etc.

Important IT innovations for container ports

The most visible and often most advanced innovation concerns ‘robots’ in all types and sizes used as autonomous vehicles; from the smaller last mile solutions to fully-automated sea-going vessels. Future developments in autonomous vehicles will undoubtedly impact the organisation of operations in container ports.

The direct impact on port operations can be seen in improved efficiency as a result of such things as error-free handling, improved planning and synchronised timing. Drones can also be used to safeguard security in the port and play a role in monitoring port activities. They can also be used to track assets that require maintenance, both in terms of port equipment and vessels. For autonomous vessels, the story is somewhat more complex. It is clear that fuel consumption of autonomous vessels is considerably lower than that of manned vessels, which also means lower emissions. And yet, there is an important hurdle:

international maritime conventions, in which the minimum crew requirements for sea-going vessels are clearly stated. Safety also continues to be a concern for the time being; for instance how unmanned vessels handle severe weather and obstacles, or how repairs are carried out during the voyage. In the long term, however, as most shipping accidents are the consequence of human error, safety at sea could certainly be substantially improved using autonomous vessels.

Internet of Things and big data

The increasingly rapid development of cheap sensors has led to more and more machinery and resources being equipped with such sensors. This effectively means that they can be tracked and that each activity, or each circumstance to which they are exposed, can be measured. Moreover, machinery and resources are capable of communicating with each other and with a network: the Internet of Things.

The Internet of Things also offers a wide range of opportunities for the container industry. A tremendous amount of data (big data) becomes available by connecting autonomous vessels, port equipment, infrastructure and freight. This offers opportunities to optimise processes and obtain increasingly more precise and real-time insight for all container industry stakeholders. Robust communication systems are indispensable in this.

Finally, the availability of big data enables full utilisation of the advantages of simulation software. Port operations can be modelled in order to analyse operational flows, trace possible bottlenecks and define improvements. An additional advantage is that such simulation software can also be used to train personnel.

Press Releases: Port Of Rotterdam

Photo Courtesy: Port Of Rotterdam

The post Port Of Rotterdam Highlights Impact Of Five Mega Trends On Container Industry appeared first on Maritime Manual.

from WordPress https://ift.tt/2EmKNn1

Ship Owners Must Look Beyond 2020 Compliance Solutions To Mitigate Risk Of Costly Failures And Downtime – Auramarine

Auramarine, the leading provider of fuel supply systems for the marine and power industries, has today urged the marine sector to look beyond just the initial choice of compliance solution ahead of the impending 0.5% global sulphur cap, and to fully understand the operational impact of using and switching to new low sulphur fuels and distillate products. Without this understanding or by not using best-in-class fuel supply systems, ship owners and operators risk engine damage and potentially catastrophic failure, as well as unexpected costs and unplanned downtime.

With so little time remaining before the 2020 sulphur regulation comes into force, the company has launched a ‘Get ready for 2020’ initiative, issuing a call to action for owners and operators to drive and encourage them to implement strategic forward planning to protect the future of their vessels and operations. Now more than ever it is crucial for shipowners to work with knowledgeable experts, allowing them to foster an understanding of how best to mitigate risks and minimise disruption, downtime, and unexpected costs and delays.

Many of the main and auxiliary engines of vessels currently in operation may originally have been designed to run on fuels that differ from the new low sulphur products that are compliant with the pending regulations. Maintaining the correct fuel viscosity and temperature at the engine inlet is crucial regardless of the fuel in use, and the fuel supply system needs to be able to deliver the fuel at the engine inlet as specified by the engine maker in order to guarantee efficient combustion.

When the 2020 regulation comes into effect, the majority of owners and operators are expected to comply by switching from high sulphur fuel oil to new very low sulphur fuel oils (VLSFOs) with a sulphur content at, or below, 0.50%, unless their vessels are equipped with scrubbers. When switching fuels, issues arise when different fuels are present in the same pipes and tank, thereby causing issues with compatibility. This typically results in sludging and blockages in bunker and service tanks, pipe runs, filters, separator internals, and fuel injection equipment; all of which can have a serious detrimental effect on the health of the engine.

Ole Skatka Jensen, Chief Executive Officer, Auramarine, commented:

“Assessing new technologies or practices is only the first step on the journey towards safe, efficient and compliant operations in a post-2020 environment. Ship owners also need to consider the potential impact that these significant operational changes will have on engines and therefore vessel performance. It is crucial that ship owners thoroughly evaluate the exact needs of their vessels at the outset of assessing which compliance solution they will employ, and set in place an efficient and effective fuel supply system that will not only protect the operational integrity of the vessel but also their profitability.

Ole Skatka Jensen, continued:

“Whichever compliance solution is employed, effective and comprehensive management of fuel supply and fuel switching, combined with proactive condition monitoring, can ultimately become the difference between a safe, complaint and efficient vessel, and unintended downtime, lost profitability and potentially catastrophic engine damage.”

As a world leader in pioneering the development of fuel supply systems, Auramarine has launched its ‘Get ready for 2020’ service offering to provide expert consultancy, comprehensive guidance and ongoing in-service support for the safe and efficient supply of fuel. Covering every aspect of fuel supply and management, ‘Get ready for 2020’ provides ship owners with a detailed understanding of a vessel’s individual fuel filtration, pump system and heating and cooling requirements to ensure a fit-for-purpose solution is in place, whilst also identifying requirements for modifications or upgrades to optimise the operational efficiency of the system.

As part of its ‘Get ready for 2020’ initiative, Auramarine’s FuelSafeTM changeover system offers a customised, cost-efficient and rapid method for enabling a vessel to use different fuel types and comply with sulphur emissions requirements while optimising the vessel’s fuel economy. FuelSafeTM is compatible for both newbuilds and retrofits, and crucially, given the short window to ensure compliance – can be quickly installed and operational, ensuring ship owners can prepare their vessels ahead of 2020 safe in the knowledge that operational integrity will be protected.

Auramarine works closely with ship owners and operators in the design and delivery of customised systems and in-service support services that can be quickly installed to the ship’s fuel handling system and implemented into its operational practices, maintaining a strong focus on providing the agility shipowners need to ensure compliance ahead of 2020.

Press Releases: auramarine.com

Photo Courtesy: auramarine.com

The post Ship Owners Must Look Beyond 2020 Compliance Solutions To Mitigate Risk Of Costly Failures And Downtime – Auramarine appeared first on Maritime Manual.

from WordPress https://ift.tt/2Ts1Z3S

GE Provides SeaStream Dynamic Positioning System To PKNU’s Training Vessel

Pukyong National University (PKNU) has chosen GE’s Power Conversion business to provide the SeaStream Dynamic Positioning (DP) system for their training vessel for fisheries industry training. GE’s SeaStream DP will enable the ship to perform operations – for example controlling horizontal movement or holding position against harsh wind and in choppy waters – with stability, safety and precision for a long time.

“We have more than six decades of onboard vessel training experience and are now adding the 14th vessel to the fleet. We are glad to work with GE, whose robust technology will contribute to us adding the largest and best equipped new vessel to our fleet,” said Professor LEE JONG-GUN, director of the PKNU Ship Training and Operations Center, PKNU.

SeaStream DP is also a smart system that will contribute to the ship’s overall efficiency and operational effectiveness.

The “Energy Efficient” mode of the DP system can help reduce fuel consumption. The position and heading of the vessel are both controlled automatically, predictive software is used to anticipate position variation and to limit thrust changes if the vessel is predicted to remain within the so-called ‘soft’ operating window, or an inner tolerance band. If the vessel is predicted to move outside its ‘hard’ operating window (outer tolerance band), the system develops optimum thrust to remain within that window. Advanced algorithms are used to optimize vessel heading to further reduce power consumption and limit thruster/machinery wear and tear.

GE studies have shown that fuel saving in this mode may be up to 10 percent or more, with an associated NOx reduction of up to 20 percent, depending on environmental factors and exact operational profile.

“GE’s DP system is more mariner friendly, which is an excellent choice for fishery training purposes. With an informative and easily-operable human-machine interface, the system provides unprecedented flexibility and effectiveness that allows operators to truly focus on their maritime operations,” said Ed Torres, CEO of marine and oil & gas, GE’s Power Conversion business.

“We have partnered with multiple universities in Korea to provide DP systems in recent years, helping to train students with valuable skills and to fuel their ambition to pursue a successful career at sea,” said Azeez Mohammed, president & CEO, GE’s Power Conversion business. “We are excited to be part of the journey, helping the next generation of maritime professionals excel with one of the most advanced technologies for efficient ship operations.”

Built by DAE SUN Shipbuilding & Engineering Co. Ltd, the training ship is 97 m long and 15.4 m wide. It has a gross tonnage of 3,990 ton and a capacity of 160 people.

Press Releases: ge.com

Photo Courtesy: ge.com

The post GE Provides SeaStream Dynamic Positioning System To PKNU’s Training Vessel appeared first on Maritime Manual.

from WordPress https://ift.tt/2INc3Ak

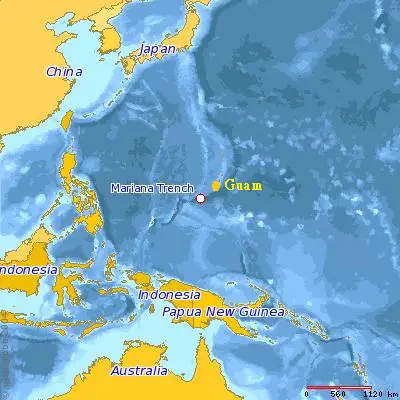

15 Deepest Parts Of The Ocean

The earth is known as the ‘blue planet’ because of its blue appearance from space. This blue color obviously comes from the oceans on earth ...

-

Oceans are still a mystery for humans. Large swathes and depths of the sea are still untouched and unvisited by us. And their lurks many puz...

-

Mitsui O.S.K. Lines , Ltd. (MOL) announced that its group company, MOL Chemical Tankers Pte. Ltd. has acquired a 20% stake in Den Hartogh Ho...

-

Under the long-term contract between PGNiG and US LNG provider Cheniere Energy, the first cargo of liquified natural gas arrived at the Pres...