Additionally, data from the IMF showed that advanced economies’ growth is on a downward trend and has been so since the mid-2000s.

“Such a development affects every shipping sector across the globe – in different ways, naturally,” BIMCO explained.

Dry bulk demand is supported by such a trend, whereas container shipping will see demand growth rates come under further pressure. Oil tankers may find it somewhat bittersweet, as demand generated in the East may be dented by a contraction in the West.

Many geo-political obstacles are in the way – the trade war between the US and China being just one of them, BIMCO added.

Dry Bulk – no fundamental improvement in 2019

One of the main risks to dry bulk Capesize market outlook is the shifting interest from imported iron ore towards scrap metal seen over the past 1 and a half years from Chinese steel mills. 2018 is a turning point in this matter, as Chinese seaborne imports are down year on year for the first 10 months of 2018.

For the Handymax and Panamax sectors, the uncertainty is linked to the development of the trade war between the US and its main trading partners, chiefly China.

Oil tankers facing more headwind

Crude oil tanker operators were particularly hit hard in 2018, a year dubbed horrific for the tanker market. The larger the ship, the lower were the earnings before October delivered a sudden reversal of fortunes, but no fundamental market balance changes that fast.

BIMCO explained that 2019 will prove to become a difficult year for the crude oil shipping sector too, with the icing on the cake being US sanctions on Iran. A four-year low fleet growth in 2018 cushioned some of the downfall of a weak demand side, but the aftermath of two years with a fleet growth of 5-6% proved too heavy to stem.

“We expect earnings to improve from the lows of 2018 and, as a result, owners will lose interest in selling ships for scrap. Fleet growth is expected to exceed 2%.”

When it comes to oil product tankers, outlook is slightly more positive, but for different reasons. Low fleet growth has teed up the market for improved earnings in 2019 when compared with the lows of 2018. The market was bad, but not as bad as the crude-oil tanker market. One of the potential positive triggers in 2019 is likely to be distribution of IMO 2020-compliant fuels.

Container shipping: fleet growth takes centre stage

“On the whole, 2018 turned out to be a disappointment, but it did have a few shiny moments. It was most impressive to watch inbound-loaded container imports on the US east coast grow by +8% on top of the 10.1% growth experienced in 2017.”

On the US west coast, volumes did not impress, but spot freight rates nevertheless hit a five-year high in October for the Shanghai to USWC trade lane.

BIMCO added that the development of fleet growth was among the disappointments. After two busy years, demolition interest evaporated completely in 2018 hitting a 10-year low. This caused fleet growth to rise higher than demand.

Looking ahead to 2019, fleet growth takes centre stage when it comes to market fundamentals.

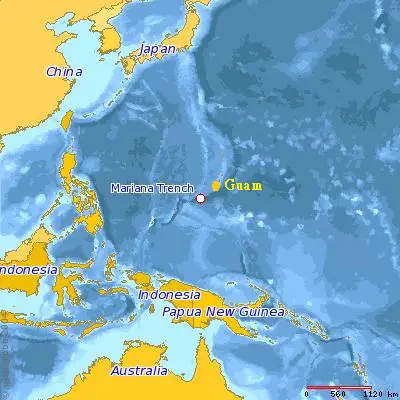

Volume growth on long-distance trades will be more critical than ever, as fleet growth is focused to fit into them. Intra-Asian trades, where most containers of any other place are moved, will also suffer if the front-haul, transpacific cargo flow stays dented because of tariff walls on either side of the Pacific, according to BIMCO.

“Will containers on rail continue to have growing significance? That will largely depend on a continued Chinese subsidy to support it. It’s not massive, but it certainly takes away much- needed volumes from the ocean.”

Press Releases: BIMCO

Photo Courtesy: BIMCO

The post BIMCO: Global Shipping on the Lookout for Future Growth appeared first on Maritime Manual.

from WordPress https://ift.tt/2Lnu5H6

No comments:

Post a Comment